As a startup managing your cashflow is of the utmost importance. Every penny spent on expenses has the opportunity cost of funding further growth. There is help at hand. We have compiled a list of innovative startups that will save you money. We hope that these ahead of the curve creative startups will get you thinking about how to enhance your growing business!

1. Mint.com (Personal Financial Planner):

Founder: Aaron Patzer (CEO)

It's a headache trying to keep on top of bills, each service provider has a different website with a different login, that you keep forgetting. Mint has taken the pain out of personal finance by bringing everything to one location. They simplify your financial world and allow you to take a high level view of whats going on without getting bogged down in the detail. Mint will also give you recommendations on savings and investments as they scan through thousands of potential deals. They make their money on click-through advertising which is presented as a savings feature on the site. Mint have been innovative in their business model by combining advertisers and customers and their goals are aligned. They make money when you save money, and when they help advertisers find a new customer.

STARTUP TIP:

When you are building your startup try to think of value added link-ups with other businesses. If your goals are aligned, the customer will reap the benefits of the synergy.

When you are building your startup try to think of value added link-ups with other businesses. If your goals are aligned, the customer will reap the benefits of the synergy.

2. Dash (Smarter Driving App):

Founders: Jamyn Edis (CEO) | Brian Langel (CTO)

This is an app that makes your car smart. All you need is the app and a small self-fitted devise that goes under your steering wheel. I think this app is going to be big. The price of petrol has gone through the roof so people can really do with an app that can teach them how to get the most fuel efficiency from their car. Dash will also tell you where the cheapest petrol station is nearby and give you market prices for the repairs you may need. Its a concern that most drivers have, thinking they are being ripped off by the mechanic, having this information at hand prevents that from happening. I don't know how many times a random light has popped on and I’ve no clue what it means. Dash solves that problem by connecting to the on-board diagnostic port to provide you with information. They expect to make their money from data sold to insurance companies, repair shops and car manufacturers.

STARTUP TIP:

When you are in the design phase of your startup, you should already be thinking of what suppliers, manufacturers and distributors may be interested in your product. If you have built a relationship before piloting the app you will have much better traction later on.

When you are in the design phase of your startup, you should already be thinking of what suppliers, manufacturers and distributors may be interested in your product. If you have built a relationship before piloting the app you will have much better traction later on.

3. Lagoon (Water Management Platform):

Founders: Eric Elias (CEO) | Nathan Heidt (CTO) | William Blum (CCO) | William Wiebe (COO)

Image credit: GoLagoon.com

Image credit: GoLagoon.com

Lagoon are a company that may begrudgingly come in handy for us Irish. They convert your water infrastructure into a smart system by attaching sensors to your pipes. It will keep an eye on your water usage for you. As has been reported there are a lot of leaks in the Irish water infrastructure. They will identify leaks before they become a problem. It is also a planning tool as well that will set targets so you can budget your water consumption.

STARTUP TIP:

Everything wants to be smart now; your phone, your TV, it’s all well and good it being smart but you need to think of ways it can add value for the customer. If there is no real benefit to the customer of the smart technology they will lose interest easily.

Everything wants to be smart now; your phone, your TV, it’s all well and good it being smart but you need to think of ways it can add value for the customer. If there is no real benefit to the customer of the smart technology they will lose interest easily.

4. Energy Elephant (Faster Way to Save on Energy Bills App):

Founders: Joe Borza (CEO) | Eoin ó Fearghail (CTO)

This Irish startup wants you to give them your bills ,while they wont pay them for you, they will identify where you can make savings. They monitor your energy-use efficiency through the app. There target audience is mainly SMEs, as these are the businesses with less of a handle on their utility expenses. Sometimes it can be as simple as pointing out that you can have day and night metres but there are many solutions to cutting energy costs. They use the Software as a Service (SaaS) business model, charging customers 0.5% of their annual bill. Energy Elephant are part of Enterprise Ireland’s New Frontier startup programme which we discuss in our article on how to fund your startup.

STARTUP TIP:

Find your niche and focus on them, don’t try and be everything to everybody. Also explore all grant option for funding. New Frontier offer 15k tax free to startups.

Find your niche and focus on them, don’t try and be everything to everybody. Also explore all grant option for funding. New Frontier offer 15k tax free to startups.

5. Currency Fair (Peer-to-Peer Platform for Currency Exchange):

Founders: Brett Meyers (CEO) | Brian Monaghan (CFO) | Michael O'Donovan (COO) | Sean Barrett (Director) | Jonathan Potter (Director)

People are wary of banks at this stage. They assume that they’re not getting a fair deal. Ireland based Currency Fair is, as the name suggests a marketplace where users set their own price and Currency Fair takes just 0.15% of the transaction. If there are no customers offering a price. Currency Fair will come in offering 0.4% to 0.5%. This is great for people who send a portion of their salary back home or who transfer frequently to a foreign currency destination.

STARTUP TIP:

As a startup you are always looking to save money. If you are exporting to a non-euro country you should think about other companies to transfer with, banks will be more expensive.

As a startup you are always looking to save money. If you are exporting to a non-euro country you should think about other companies to transfer with, banks will be more expensive.

6. Womply (Platform that Links Merchants' Discounts to Payment Checks):

Founders: Toby Scammell | Jeremy Richardson (Director of Product)

These guys compile data from different sources to allow you to make better decisions. Whether that is marketing, operations or employee management. They set you up so you can monitor your business reputation online and can deal with complaints as quick as possible. They also have a monitoring service so you can keep tabs on competitors and react quickly. With Wobbly you can directly compare your revenue to other businesses and monitor performance in a pain free way. Its like an electronic business advisor that will address how external factors will effect your business like the weather or holiday season. This is really innovative I don’t know of any other app that can do this to that level of detail and it’s something that businesses will find really useful.

STARTUP TIP:

As a startup nurturing your online reputation can be the difference between life and death. You are your reviews. It might be time consuming to keep tabs on defending your reputation on sites like yelp or trip advisor, but its a high priority.

As a startup nurturing your online reputation can be the difference between life and death. You are your reviews. It might be time consuming to keep tabs on defending your reputation on sites like yelp or trip advisor, but its a high priority.

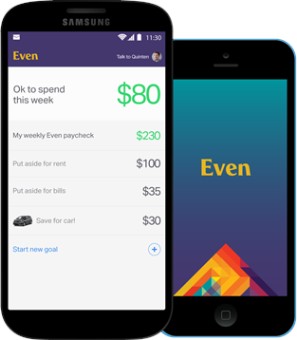

7. Even (Interest-Free Loans for Irregular Paychecks):

Founders: Ryan Gomba | Quinten Farmer | Cem Kent | Jon Schlossberg | Evan Goldschmidt

Image credit: WhatisEven.com

Image credit: WhatisEven.com

This startup is very different than your average. Its target market are those on low wages struggling to pay their bills. It's one of the few startups I’ve come across that seeks to fill a need for those with the least money. The idea is that you hand over control of your weekly finances to Even and they budget your cash-flow like an insurance policy. When an unforeseen expense arises you have a pot to dip into and avoid extortionate interest rates that accrue on payday loans. They charge you $5 per week for the service which seems expensive enough if you are living hand to mouth, but avoiding defaulting on your bills, or losing your home are much worse scenarios.

STARTUP TIP:

Not all opportunities are geared towards the middle class. Thinking of a different target markets can be a good way to find blue skies with fewer competitors.

Not all opportunities are geared towards the middle class. Thinking of a different target markets can be a good way to find blue skies with fewer competitors.

8. Tile (Lost and Found - Wallet Finder and Key Locator):

Founders: Mike Farley (CEO) | Nick Evans (Advisor)

This app is bound to help you save money replacing lost items. Its a tracker that attaches to wallets, purses, keys or whatever else. The key differential here from apps such as Find My iPhone is that you can utilise a network of Tile users to help you find an item, whether that is a close knit tile group such as your office co-workers or random people in close proximity. They claim to find over 250k items a day. Its very handy that the lost item plays a little jingle while you search for it. Right now Tile have Easter eggs hidden around San Francisco for tilers to find, one of which has a $1000 prize.

STARTUP TIP:

The key innovation here is creating a network of people who use the app, the users themselves are keen to share and get more people on-board because they have vested interest. This is a great model to grow a business.

The key innovation here is creating a network of people who use the app, the users themselves are keen to share and get more people on-board because they have vested interest. This is a great model to grow a business.

9. TinBox (Mobile App that Allows You to Give 1 Euro a Day to Charity for Free):

Founders: Adrien Guilmineau | David Linderman

This startup will allow you donate to a charity without actually spending any money. Companies sign up and allow you to donate €1 a day to certain charities. Its a good way for people who can’t afford to donate to charity to still feel they are contributing. It also gives more visibility to companies philanthropic side. People have an image in their head of companies as profiteering

behemoths but most give considerable money to charities behind the scenes. For instance, last year in France where the app’s founders are from, companies gave over €2 billion to charity. Its a nice way for companies to show their better side and for people to engage in charitable activities without it costing them money.

STARTUP TIP:

Building your reputation is paramount for startups and if you can do this by doing something altruistic than all the better. People want companies to have a good heart.

Building your reputation is paramount for startups and if you can do this by doing something altruistic than all the better. People want companies to have a good heart.

10. Shopkick (Rewards Shopping App):

Founders: Cyriac Roeding (CEO) | Jeff Selinger (CPO) | Aaron Emigh (CTO)

This is a really cool Palo Alto startup that, in conjunction with big retailers like Toys R’Us and Macy’s, sends your phone discount offers when you walk into a store. There is no need to log in to anything. The store sends out a sound signal that your phone’s microphone picks up and relays back to you. Described as being your best shopping buddy offering you deals as you go from shop to shop saving you money on your purchases.

STARTUP TIP:

How do you marry customer benefits with convenience of delivery? If you manage to bring both to the table your customers will respond well.

How do you marry customer benefits with convenience of delivery? If you manage to bring both to the table your customers will respond well.

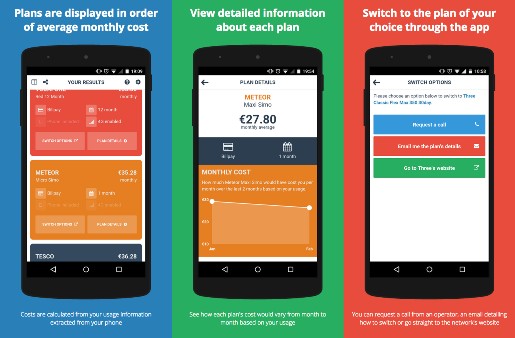

11. KillBiller (App that Helps you Find the Cheapest Phone Deal):

Founders: Shane Lynn (CEO) | Bart Lehane (CTO) | Ciaran Tobin (CIO)

There are over 100 mobile phone plans available on the Irish market, picking the most suitable one for you can be the difference between spending €20 per month and spending €100 a month. Yet how do you know what that most suitable plan is? How many minutes do you need per month? How much data? What networks do you call and text most often, and would switching to that network make a difference? These are the questions that KillBiller answer for you with a few taps of a smartphone screen. The KillBiller application looks through your call, message and data history and figures out how much each plan available on the market would cost you per month. You can then get further information via the application and even call directly into your selected operator to facilitate a switch.

STARTUP TIP:

Measure, Measure Measure. Make sure you are clear about what goals you want to achieve and describe what success looks like. Then relentlessly measure your performance against those goals. This saves a huge amount of time and guesswork.

Measure, Measure Measure. Make sure you are clear about what goals you want to achieve and describe what success looks like. Then relentlessly measure your performance against those goals. This saves a huge amount of time and guesswork.

Michael is a recovering accountant. Having subjected himself to a litany of exams he decided that life is too short to count beans so instead he wants to chance his arm writing. When he is not with ink and quill you can find him levitating in a local yoga centre or baking caramel squares. Freelance content and copywriter, covering short and long content pieces across various different media forms. Don't forget to connect with Michael on LinkedIn and say Hi!: ie.linkedin.com/in/mrmichaelmclaughlin

Michael is a recovering accountant. Having subjected himself to a litany of exams he decided that life is too short to count beans so instead he wants to chance his arm writing. When he is not with ink and quill you can find him levitating in a local yoga centre or baking caramel squares. Freelance content and copywriter, covering short and long content pieces across various different media forms. Don't forget to connect with Michael on LinkedIn and say Hi!: ie.linkedin.com/in/mrmichaelmclaughlin