A few years ago, Enterprise Ireland, Ireland’s national enterprise agency introduced the Competitive Start Fund to assist early stage startups. A brilliant and hugely vital initiative for startups, CSF facilitates Enterprise Ireland to invest €50,000 for 10% equity. This post will provide first-hand experience of what the state agency is looking for in a well completed application.

Disclaimer: Ideas and advice in this article are those of the author and don't necessarily reflect those of Enterprise Ireland.

Enterprise Ireland and Competitive Start Fund:

This post is written for someone who knows all about CSF, has probably already registered to complete the application form, and is looking for pointers on how to complete it. I hope that this post will be useful if you are trying to answer the question, ‘Does this application fully reflect the potential of my business?’ But firstly, some information by way of general background:

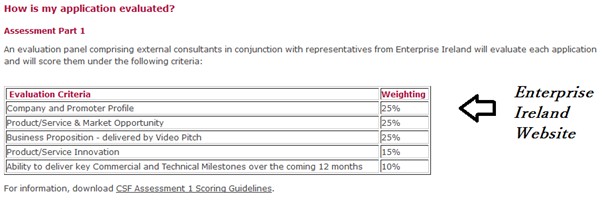

Enterprise Ireland has a very good information based website. This includes a regularly updated CSF section which is part of the larger area dedicated to Early Stage Startups. This includes all the technical detail relating to the operation of the programme to include dates of upcoming calls. The website outlines the criteria used to judge all applications received. A detailed breakdown of the marking scheme is available to download. I would also strongly recommend reading this New Frontiers blogpost all about CSF as written by a representative of Enterprise Ireland – it includes a link to download a blank version of the application form in Word.

CSF operates in Calls. Every 6 to 8 weeks (six to eight times a year), Enterprise Ireland will issue a call for applications in order to identify up to 15 businesses for investment of €50,000. The evaluation is conducted in two phases:

Phase 1 involves a review of a text based application and a pre-recorded video. This author won a tender competition and was privileged to be selected to join the External Evaluation panel for first phase evaluations. I have undertaken the evaluation on about 5 or 6 occasions. Please note that I am completely independent of Enterprise Ireland and this post does not represent the views of the state agency. At the same time, I know a number of businesses who have benefitted from CSF as I am a trainer on New Frontiers in DKIT, GMIT, LyIT and IT Sligo, and IT Tralee and many of the businesses on these accelerator programmes will in due course apply for CSF. The process used for selecting the companies for investment can in my view be described as: robust, equitable and very well managed. Our job is to work in pairs (one external plus one Enterprise Ireland Development Advisor) to review each application and score it according to the criteria.

The top 30 scoring applications are then invited to Phase 2 which is a 4 minute pitch plus Q&A to another panel, with 15 securing the investment. I have no involvement with the second phase of the CSF evaluation process so this post does not address that. As with any investment selection process it is of course subjective but in my view the vast majority of companies selected for investment both need the money and are hugely deserving of it. I recently met for one hour with a group of startup promoters, who were in the process of applying for CSF, in the Nexus Innovation Centre in the University of Limerick – this post records some of my comments to this group.

1. Familiarise yourself with the marking scheme:

The criteria are detailed on Enterprise Ireland website.

2. Start completing the form in good time:

Most startups are busy, and I imagine that it takes at least a week of actual time to complete the form. It is 15 pages when blank. So if you are not used to completing forms I suggest breaking up the process and making a start as soon as the call opens.

3. Think about your milestones:

A lot of startups have told me that the CSF application process was beneficial in itself and it got them to think about their business. I usually am thinking to myself, ‘that is great. Very true, but if you are only thinking about your business because you are prompted by CSF, then there will probably be lots of gaps’. The best applications are when you have lots of business planning and market testing done and the CSF form is the platform to showcase the results i.e. give a very clear message.

In this regard, one of the final sections of the form is the Milestones. When reading the forms one often gets the sense that the applicant is getting tired, that they are weary of the form filling process, and maybe rushing to meet the deadline by the time the milestones section is to be completed. Applications suffer as a result. So what do good applications look like in terms of milestones:

- Firstly, every business is different so the milestones must be relevant to their stage of development and the timeframe that they have set i.e. 6, 9 or 12 months.

- I suggest 3 or 4 technical milestones that collectively paint a picture of how the product solution is going to develop over the period. All the milestones need to be important to the business and customers. So Feature One will be part of Release 1.0 and that will happen in 3 months. Subsequent milestones will probably focus on other dimensions of the operation and build on earlier milestones.

- I suggest 4 to 5 Commercial milestones, again following the SMART format, so perhaps Product will be available in 100 retail outlets in Ireland within 3 months of launch. The follow on milestone could be to launch in UK, and other milestones could relate to hiring first senior management personnel, securing route to market partners, launch of an eCommerce site or attend US Trade Show. The possibilities are not quite limitless but if you have your business planning done, this is a section in which your business should shine.

4. Don't worry too much about Intellectual Property:

CSF isn’t just for world first disruptive innovations and/or businesses with patents. The standard reached by most of the companies who get to pitch, under the Innovation heading, is that they have identified a real problem of an identified customer base, and have a viable solution that allows them to compete in the real world. So if a business has limited Intellectual Property in terms of Patents there will be no issue if it has a really superb design, user interface or other compelling feature in terms of how the problem is solved.

Strong IP will obviously be a bonus, but according to the criteria, is not the deciding factor. The picture presented with regard to IP and technical development and the ability to operate on the international stage will be reinforced by the Milestones section particularly if resources are identified as being required for product development.

5. Big up the Team:

This headings is to be taken two ways. Firstly, don’t be modest. If you have a track record please make sure the reviewer know why it is relevant. And secondly, present a team. Advisors should be a big part of the mix. In CSF, you will be competing against businesses led by promoters with strong functional skills (IT, Marketing, Finance, Operations etc); with serious domain and industry knowledge; with internationalisation and startup experience. They will present Advisors such that collectively they present a vision of a business led by a balanced team that can deliver (the milestones set out later in the document).

6. Present a clear Value Proposition:

A value proposition must outline ‘the must have benefit’ that solves a real problem for an identified group of customers. It is important to spend time thinking about your UVP as it is certainly true that ‘Clarity of thought precedes clarity of expression’. When delivering startup training, I discuss how to formulate a UVP by reference to identifying the ‘finished story benefit’, and in this regard I have written a blogpost on the topic for New Frontiers blog referencing the Value Proposition canvas:

www.newfrontiers.ie/blog/value-proposition-tool-formula

7. Describe and quantify the Market Opportunity:

To select the top 30 for progression to pitch stage is not easy. The standard is extremely high – there are many very credible startup businesses also applying as early seed investment of this level is in short supply in Ireland.

One area where those who get to pitch stand out is clear identification of the market opportunity particularly the international market potential. I would suggest firstly naming and quantifying the top level market in which your business competes to show the global scale, and then identifying specific niche markets.

It is very important to provide references for the information sources.

For example, an in depth analysis (relying solely on reports sourced using an Advanced Google Search) of the Global Dental Surgery Equipment market found:

• Global dental equipment and consumables market is estimated to be $26 billion by 2014 according to BioMedTrends.com

• Worldwide sales of dental surgical equipment are projected to reach $4.9 billion by 2015 - United States and Europe collectively account for more than 70% share of the worldwide dental surgical equipment market for 2008, as stated in a recent report by Global Industry Analysts, Inc.

It is also important to identity and quantify the current addressable market. This has a very specific definition from IntertradeIreland’s Business Cube whereby you identify the size of the market that your business could address given its current or expected resources available to it over next year or two.

8. Present supportive Competitive Analysis:

The identification of the market will reinforce understanding of both the problem and solution as outlined in the application. Similarly, the information provided on the competition must support the impression that this is a business worthy of investment. The ideal message to present on competition would highlight that there is competition as evidence of demand; that the market is not particularly dominated by a small number of large price sensitive competitors; and that customers value innovative new approaches and solutions. If your competitive analysis does not match this ideal scenario, then you need to convince the review panel that your business has the ability and a model to compete in what is probably a highly competitive marketplace.

9. Practice the Video:

The video submission system allows ample time and opportunity to practice answering the video questions. My advice is to keep the message simple. But how? Assume that the reviewer will look at the video first so pretend you are meeting someone for a cup of tea or coffee to discuss your business for the first time. So for each question, list the top three things you would like the other person to know about that aspect of the business. When you keep the message simple, you can focus on delivery. Your confidence and passion will come across and an impression that this is a credible person will be created. As such I would suggest, if appropriate, within the video to refer to the application if you find yourself delving into too much detail such that the message is getting lost. So don’t try to explain everything by cramming all the detail into one minute but focus on what the review panel really wants to know – mainly relating to the business side and particularly answering the question, ‘Will and how will this business make money’.

10. Pricing:

It is also important to note that the form or video does not specifically ask the startup to indicate their pricing. But this is a hugely important detail. My advice is to include it in the video and also in the application.

11. Bullets plus other relevant links:

The CSF form, like many online forms, does not have a facility for putting information in bullet form. Bullets are a great way to summarise. I suggest typing text where you need bullets in Word, and copying the text with bullets into the CSF form. My other minor tip relates to the ‘Other relevant links’ section where applicants can put in YouTube videos links etc. I suggest creating a 2 page product summary brief with some text but mainly images such as product schematics and maybe a screenshot. In the form, add this document as a dropbox link, and explain that it is a two page flyer that will take two minutes to review. Don’t expect the reviewers to wade through lots of material.

12. If at first, you don't succeed:

Get the feedback, and do two things. One see how could you improve the application to include the video and secondly (much more important) improve the business – not always easy I concede without money but that is what other startups have done when they were initially refused.

Concluding point:

The aim of this post is not to provide a ‘Paint by Numbers’ guide to completing CSF. It is also not a guaranteed formula for success. It is rather to point out issues that I think startups might overlook when they complete CSF such that they fail to represent the full potential of their business in the application and fail to justify the case for investment because of lack of communication skills.

I am sure that everyone has read and would agree that ‘Every business to secure investment must tell a coherent and compelling story’. Great advice and I hope that by using CSF as the backdrop that I have shed some light and provided some direction on how in a practical way to tell the story of your business. Best of luck!

A self employed Business Advisor and Mentor, Donncha Hughes specialises in working with early stage technology and knowledge oriented businesses to deliver growth. Notable achievements include the award to a client company of the Regional Winner prize valued at €20,000 in the 2014 InterTrade Seedcorn Competition whereby the company subsequently secured private investment matched by Enterprise Ireland as a HPSU.

A self employed Business Advisor and Mentor, Donncha Hughes specialises in working with early stage technology and knowledge oriented businesses to deliver growth. Notable achievements include the award to a client company of the Regional Winner prize valued at €20,000 in the 2014 InterTrade Seedcorn Competition whereby the company subsequently secured private investment matched by Enterprise Ireland as a HPSU.

Based in Galway, and working with clients across Ireland, Donncha curates Startup Digest Galway on a voluntary basis, and most recently has been involved in the launch of 'Startup Galway Pitches Meetup' which provides a forum for startups to practice a pitch that they need to make for their business.